Investopedia is a leading online resource for financial education, offering comprehensive and accessible information about investing, personal finance, market analysis, and economic trends. Founded in 1999, it caters to individuals ranging from beginners to seasoned investors, as well as financial professionals.

Key Details About Investopedia:

- Overview:

- Founded: 1999.

- Headquarters: New York City, USA.

- Ownership: Part of Dotdash Meredith, a media company known for its portfolio of trusted online brands.

- Purpose: To provide clear, reliable, and actionable financial knowledge to empower users to make informed financial decisions.

- Content and Features:

- Educational Articles:

- Covers a wide range of topics, including investing, retirement planning, tax strategies, budgeting, and economic principles.

- Financial Dictionary:

- One of the most comprehensive online dictionaries for financial and economic terms, providing clear definitions, examples, and related concepts.

- Tutorials and Guides:

- Offers beginner-friendly and in-depth guides on topics like stock trading, cryptocurrency, real estate, and insurance.

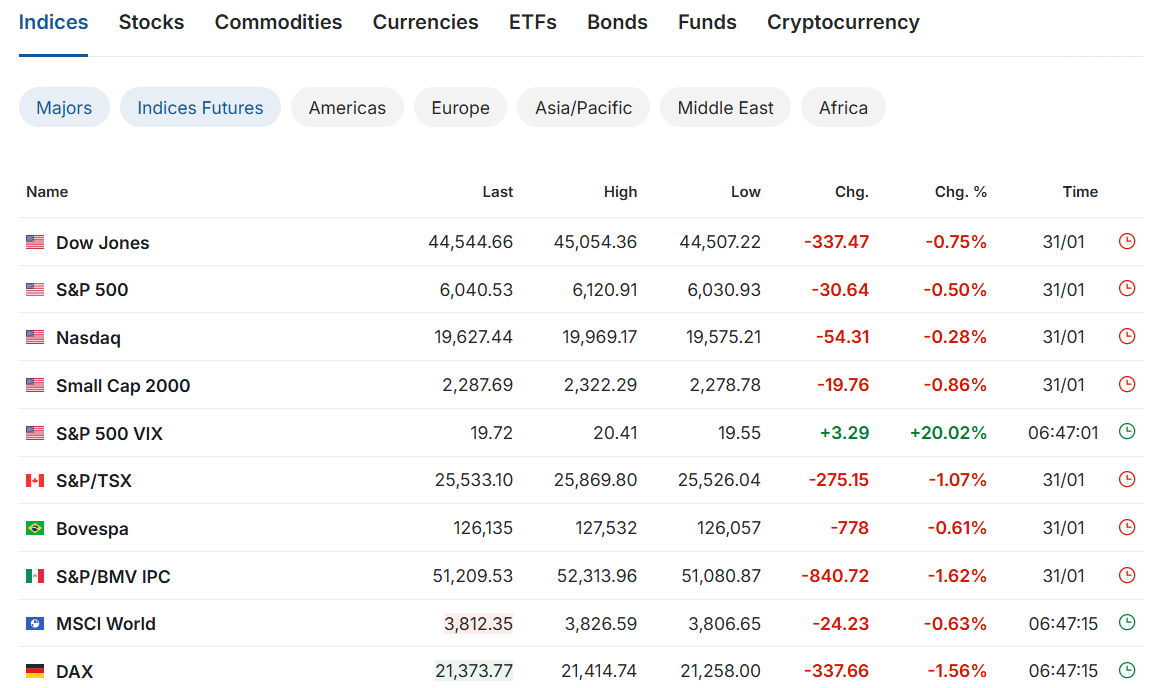

- Market Analysis:

- Regular updates on stock market trends, economic indicators, and expert commentary.

- Investing Simulator:

- A virtual stock market simulator where users can practice trading and portfolio management without risking real money.

- Tools and Calculators:

- Includes tools for retirement planning, loan calculations, mortgage assessments, and more.

- News and Insights:

- Features breaking financial news, analysis, and thought leadership on economic issues and trends.

- Financial Advisor Directory:

- Connects users with certified financial advisors in their area.

- Educational Articles:

- Audience:

- Investors: Beginners and experienced investors seeking tools, tips, and market insights.

- Students: Individuals studying finance, economics, or business.

- Financial Professionals: Analysts, advisors, and accountants looking for reliable resources.

- General Public: Anyone interested in understanding personal finance and improving financial literacy.

- Membership and Accessibility:

- Free Content:

- The majority of articles, definitions, and tutorials are free to access.

- Investopedia Academy:

- A paid platform offering video courses on topics like stock trading, options, and personal finance. Courses are designed by experts and include interactive content.

- Free Content:

- Unique Features:

- Comprehensive Dictionary:

- The financial dictionary is a flagship feature, with thousands of entries explained in simple language.

- Virtual Stock Market Simulator:

- Allows users to practice trading strategies, making it a popular tool for learning about investments.

- Investopedia Academy:

- High-quality, self-paced courses for users looking to deepen their understanding of specific financial topics.

- Expert Contributions:

- Content is created and reviewed by financial professionals to ensure accuracy and relevance.

- Comprehensive Dictionary:

- Global Reach:

- While Investopedia primarily targets an English-speaking audience, its global perspective on financial markets and economics makes it useful for international users.

- Community Engagement:

- Interactive Tools:

- Simulators and calculators encourage user participation.

- Comments and Feedback:

- Articles often include spaces for user engagement and queries.

- Social Media Presence:

- Active on platforms like Twitter, LinkedIn, and Facebook, where it shares news, tips, and updates.

- Interactive Tools:

- Reputation:

- Renowned for its reliability, clarity, and breadth of information, Investopedia is a trusted source for financial education.

- Frequently cited by media outlets, academics, and financial institutions.

- Competitors:

- The Motley Fool: Focuses more on stock recommendations and investment strategies.

- Morningstar: Known for its detailed analysis and research on mutual funds and stocks.

- NerdWallet: Specializes in personal finance tools and credit card comparisons but is less focused on market analysis.

- Yahoo Finance: Provides real-time financial news and data but lacks the educational depth of Investopedia.

- Challenges and Limitations:

- Some content, like Investopedia Academy courses, requires payment.

- The broad scope may make it overwhelming for users seeking specific or niche financial advice.

Summary:

Investopedia is an indispensable resource for anyone looking to improve their financial literacy or make informed investment decisions. Its blend of educational articles, tools, and expert insights makes it a trusted platform for financial knowledge. Explore it at www.investopedia.com.